Middle market borrowers face some unique challenges when securing finance for their commercial real estate (CRE) projects. However, this mid-level asset class continues to intrigue investors and developers alike. And industry observers regard it as a space with excellent investment and high growth potential.

So how do you secure the funds you need for your promising, middle market development project? From structured financing to the legal fine print, this article will walk you through the essentials of what you need to know.

Real Estate Finance And The Middle Market

Generally speaking, a middle market CRE property is defined by its transaction price of approximately $2 to $50 million.

Such projects are often priced just over the bar that would qualify the borrower for special lending programs such as government-backed SBA loans. And at the other end of the spectrum, brand-name capital firms tend to pass on middle market projects in favor of more premium properties, since these high market assets promises to net greater returns in relation to the same types of loan administration costs.

Middle Market Demand And Opportunity

Middle market price points often correlate to properties located in so-called secondary markets, or non-major metropolitan areas. Premium, high market properties are typically located in one of the six major (and most expensive) U.S. cities: Boston, Chicago, Los Angeles, New York, San Francisco, or Washington, D.C. You’re more likely to find middle market properties in secondary yet still bustling cities like Atlanta and Dallas.

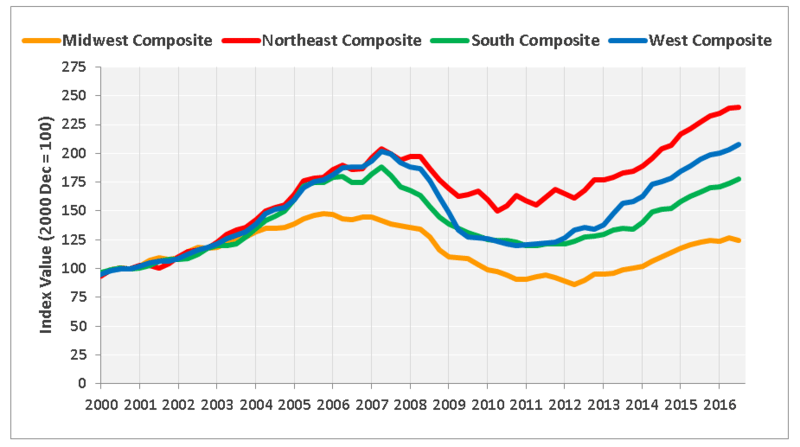

Besides locale, how do middle market assets differ from their up-market counterparts? For one thing, the major metropolitan areas attract CRE investors from not just the U.S. but around the world, and the rising prices driven by this high saturation of buyers can lead to a perception of overvaluation. Middle market properties, by contrast, tend to draw more local interest, including interest from owner-occupant businesses. Such factors may contribute to the relative financial stability of the middle market as compared to the more volatile upper end with its steep peaks and valleys in pricing.

In fact, some analysts have charted consistently higher capitalization rates for the middle market (non-major metro) versus high market (major metro) areas. And other observers have commented on the relative shortage of new construction projects and affordable multifamily housing in the middle market or small-cap sector, which presents an opportunity for savvy investors and developers to fulfill the high demand for new supply in growth markets like Fresno and Tucson.

CRE Quarterly Indices by Region – source: NAIC.org

Where To Seek Funding

As noted earlier, middle market developers and investors fall into a price-range gap where they may not qualify for a loan from a traditional funding source. They also need to maximize their debt leverage while at the same time limiting their partner and sponsor equity. Developers face the additional challenge of rising construction and labor costs, and nearly every small-cap project involves multiple investment parties who will need to be written into any financing agreement.

Given such unique capital needs and complex project conditions, most large national banks don’t have the willingness or the right types of loan products to finance construction deals for middle market investors. Fortunately, there are many alternative funding sources that small-cap borrowers can go to for help.

Smaller regional or community banks will sometimes consider borrowers who don’t fit the client profile sought by a big-bank lender. But for even greater flexibility in financing options, look to private lenders such as family firms or boutique capital funds. These private companies specialize in creative funding solutions, such as structured debt and equity arrangements, that can effectively address the unique needs of middle market borrowers.

Loan Terms

In broad terms, commercial lenders expect borrowers to provide a 20% to 25% down payment for a mortgage with a maximum loan-to-value (LTV) ratio of 75% to 85%. The typical amortization period for a CRE loan is around 25 years at a fixed interest rate, though many mortgages have even shorter terms of between 5 and 10 years.

Consider Debt & Equity Structured Finance

Debt & equity structured finance is a type of financing suited to borrowers who have complex and sophisticated funding needs. Structured financing is typically non-transferrable, which means that its debt can’t be moved between different instruments as is possible with a conventional bank loan.

The following sections describe some of the different financing approaches and considerations to keep in mind when structuring a deal.

Bridge Loan

This is a form of short-term capital that holds the borrower’s debt service for a certain period as the borrower transitions into a different financial situation. For example, the borrower may obtain a bridge loan to finance their construction project, with the expectation of refinancing into a conventional fixed-rate mortgage after the building project is complete and the property begins to generate cash flow through rental income.

Bridge loans typically offer 6 to 12 months of payment-free financing at a higher interest rate than conventional loans.

Mezzanine Financing

This is a flexible type of subordinate financing that can be structured in a variety of ways involving either debt or equity arrangements. Some of these structures include preferred equity, junior debt, convertible debt, and participating debt, covered in more depth below. As its name suggests, mezzanine financing operates like an add-on to the borrower’s primary source of capital, such as a conventional mortgage. As a higher-risk form of financing, mezzanine instruments come with higher costs to the borrower than conventional financing products.

Preferred Equity

This is where the capital source makes a preferred equity investment in the commercial development deal. Unlike the other investors who have a common equity stake in the deal, the preferred equity investor has the privilege of receiving a fixed return in advance of the distributions paid to the common investors.

Junior Debt

This is also known as subordinate financing. Junior debt refers to a secondary source of capital added on to the primary source, also known as the senior loan. Borrowers use junior loans when they need to borrow more than the amount legally permitted from a single loan. The borrower repays the junior or subordinate loan only after repaying their senior loan in full.

Convertible Debt

In this arrangement, the lender and borrower work out an agreement for a loan that can be converted later into equity, under certain agreed-upon conditions.

Participating Debt

This is a form of financing well-suited to development who expect that their finished construction project will attract reputable, financially solid tenants with long-term leases. In participating debt, the capital lender agrees to finance the project in return for interest payments and a share of the cash flow that will be generated by the property through revenue such as rental income and retail sales.

Don’t Pass Over The Legal Details

Commercial real estate financing is a complex process involving numerous agreements, documents, and legal notes devised to protect the interests of borrowers and capital creditors alike. Here are just a few of the legal instruments that you might expect to encounter before closing a debt or equity deal:

- Mortgage and deed of trust

- Promissory notes outlining plans of action in the event of a loan default

- Assignment of Leases document granting additional security to the creditor

- Uniform Commercial Code (UCC) financing document, which perfects the security interests in the property

- Environmental indemnity agreement, which protects the creditor from claims or losses resulting from environmental contamination of the property

- Subordination, non-disturbance, and attornment agreement (SNDA), which describes the post-foreclosure or post-default relationship between the creditor and tenants of the property

- Estoppel certificate, which confirms the leasing terms currently in effect for existing tenants of the property

- Loan guaranty, which stipulates debt payments by a third party in the event of a default

Moreover, CRE exchanges fall under IRS Code Section 1031 and are subject by law to certain tax requirements. With so many critical details to review, it’s no surprise that the American Bar Association recommends that you consult with a legal advisor when securing funding for a CRE project.

Closing Thoughts

Despite the apparent hurdles, an array of effective funding options awaits middle market borrowers who expand their sights beyond traditional lending institutions. With its attractive capitalization rates and healthy recovery from the 2008 financial crisis, the middle market represents an exciting asset class that offers promising opportunities for both the investors and developers of new construction projects.

We trust that you find this article insightful and meaningful. Our team is available to assist you with your real estate financing and capital solutions. We look forward to the opportunity to serve you in the near future. You can reach us or call us here!